child tax credit 2021 october

15 is a date to watch for a few reasons. 112500 for a family with a single parent also called Head of Household.

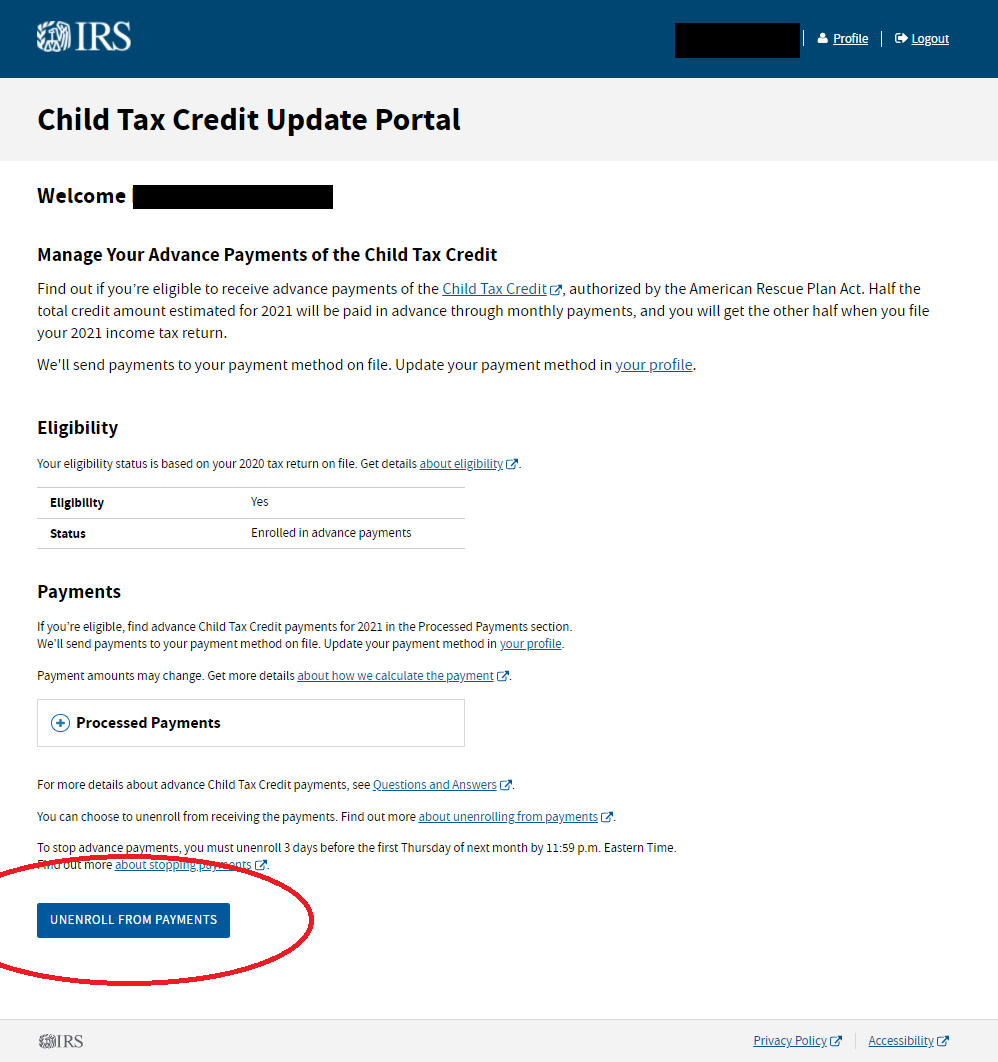

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The child tax credit has also been increased for the 2021 tax year to 3600 per child ages 5 and under and 3000 per child ages 6 through 17 up from 2000 per child.

. The taxpayer must have a dependent entered to enable the Child tax credit strategy. It is intended to give the highest Child Tax Credit ever and historical assistance to the most significant number of working families ever. That drops to 3000 for each child ages six through 17.

See what makes us different. Is there a child tax credit for October 2021. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

You cannot save until you enter the required information. The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what the monthly poverty rate in October would have been in its absence. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18.

Children who are adopted can. Children who are adopted can also qualify if theyre US citizens. Most of us really arent thinking tax returns in mid-October.

Children who are adopted can also qualify if theyre US citizens. A child born before the end of 2021 will also qualify for up to 3600 toward the Child Tax Credit. If you need to add a dependent.

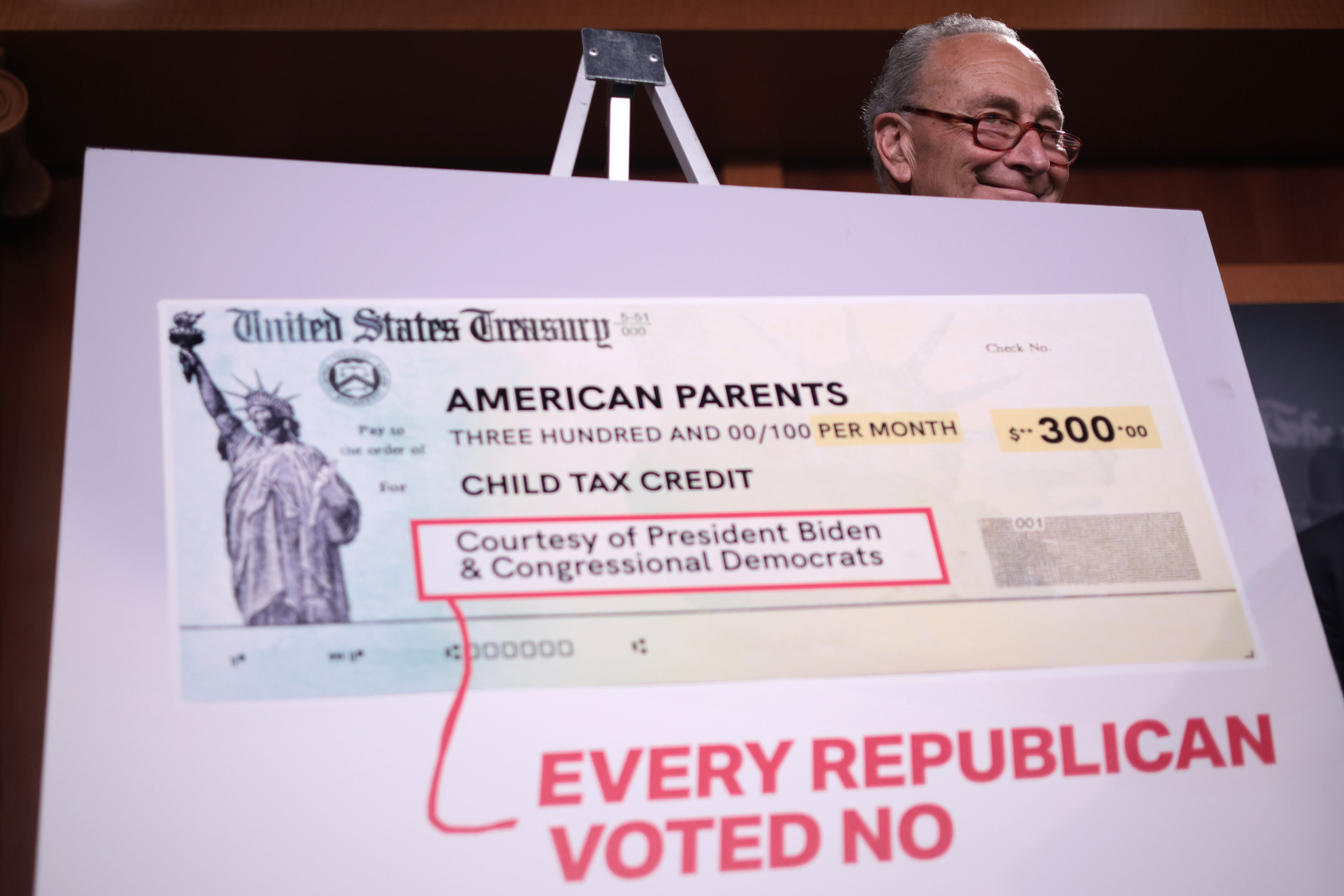

For fiscal year 2021 the Child Tax Credit increased from 2000 per eligible child to. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. The next advance Child Tax Credit payment goes out later this week with direct deposits arriving almost immediately and mailed checks taking a little longer.

In 2022 the range is 560 to 6935. If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. The Child Tax Credit is a part of the American Rescue Plan.

The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. 1052 AM PDT October 15 2021 The October installment of the advanced child tax credit payment is set to start hitting bank accounts via.

File a federal return to claim your child tax credit. Children who are adopted can. Press the edit pencil icon next to Profile.

3600 for children age 5 and under at the end of 2021. For 2021 only the amount of the child tax credit increased from 2000 for each child 16. We dont make judgments or prescribe specific policies.

Ad E-File Your Taxes for Free. The Child Tax Credit will aid the welfare. If a taxpayer wont be claiming.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families.

Select View tax plan for the desired plan. How much will the tax credit be in October 2021. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6.

Simple or complex always free. As of July 15 the vast majority of families automatically receive 250 or 300 per child every month. For the 2021 tax year the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children.

So each month through December parents of a younger. That depends on your household income and family size. The Child tax credit strategy will need to be added.

The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. IR-2021-201 October 15 2021. Will there be a child tax credit in 2021.

That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year 250 per month not 3600 300 per month. For 2021 only the child tax credit amount is increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or. 3000 for children ages 6 to 17 by the end of 2021.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. 150000 for a person who is married and filing a joint return. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Parents must fall under certain income thresholds in order to receive the full credit 150000 if married and filing jointly 112500 for heads of household and 75000 for. The rebate caps at 750 for. If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Gst Input Tax Credit Tax Credits Indirect Tax Tax Guide

Childctc The Child Tax Credit The White House

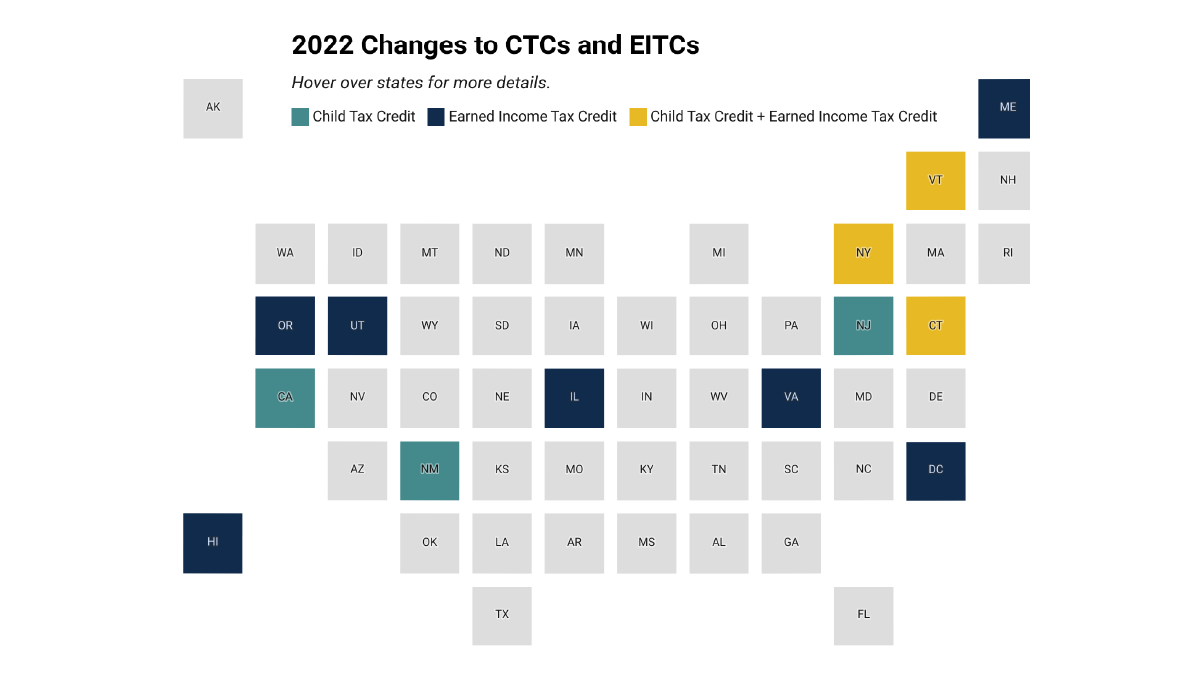

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Here S Who Qualifies For The New 3 000 Child Tax Credit

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

2021 Child Tax Credit Advanced Payment Option Tas

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

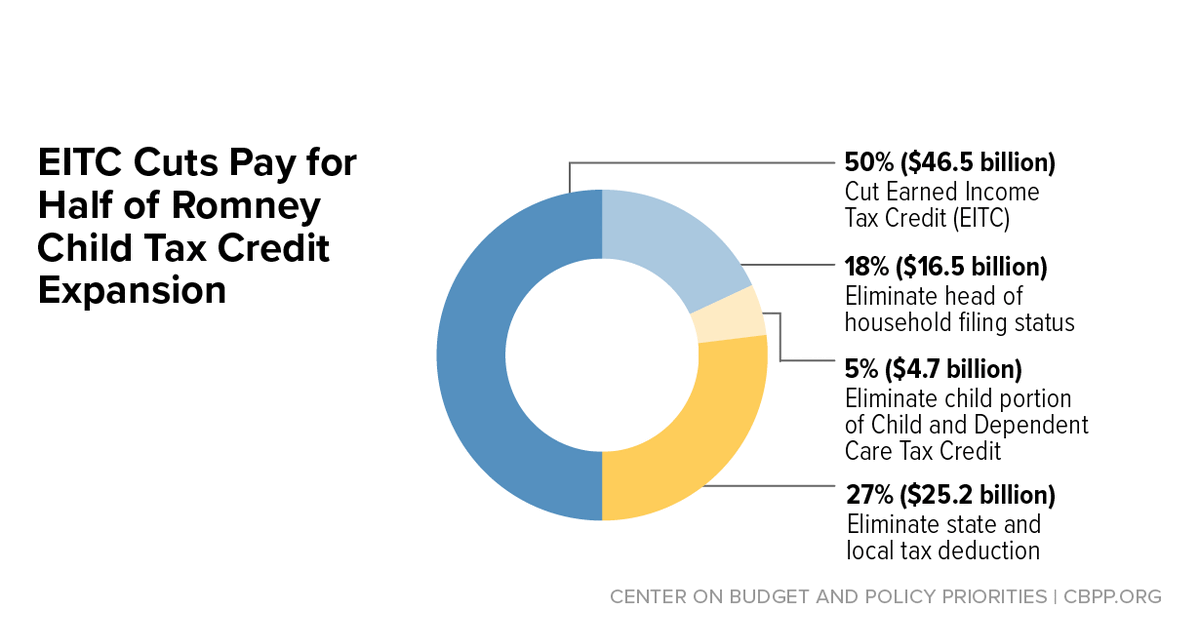

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital